Why LFP Dominates Grid Storage

LFP and contenders in the race for affordable and safe stationary energy storage

Welcome to Lithium Horizons! This newsletter explores the latest developments, companies, and ideas at the frontiers of energy materials. Subscribe below to get the next article delivered straight to your inbox:

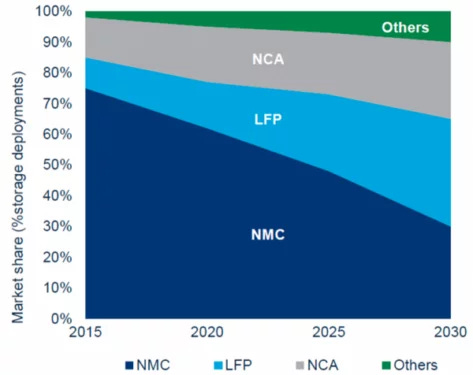

Not long ago, forecasts painted a very different picture of the battery energy storage system (BESS) landscape. Graphs like the one in Figure 1 predicted that by 2030 LFP (lithium iron phosphate) would claim around 40% of the market, while nickel-rich chemistries such as NMC (lithium nickel manganese cobalt oxide) and NCA (lithium nickel cobalt aluminum oxide) would still hold more than 20%.

Fast-forward to 2023, and the reality looks very different: LFP already accounted for roughly 80% of new storage deployments, NMC survives mainly in legacy installations, and NCA has all but vanished from the sector.

This rise of LFP owes much to the scale and momentum of China’s battery industry and is a sharp reminder of how quickly market dynamics can overturn even the most confident forecasts. Still, patterns are emerging, and by studying them we can make informed (though humble) guesses about what lies ahead.

The Role of Energy Storage in Modern Grids

As power grids modernize and renewable energy generation grows, there is a need for battery systems to increase grid resilience.1 Unlike traditional power plants, renewable generation is variable, and this variability creates a mismatch between when energy is produced and when it is most needed.

BESS bridges this gap by enabling energy shifting: capturing surplus energy during periods of low demand or high generation, and releasing it later when demand surges or generation drops.

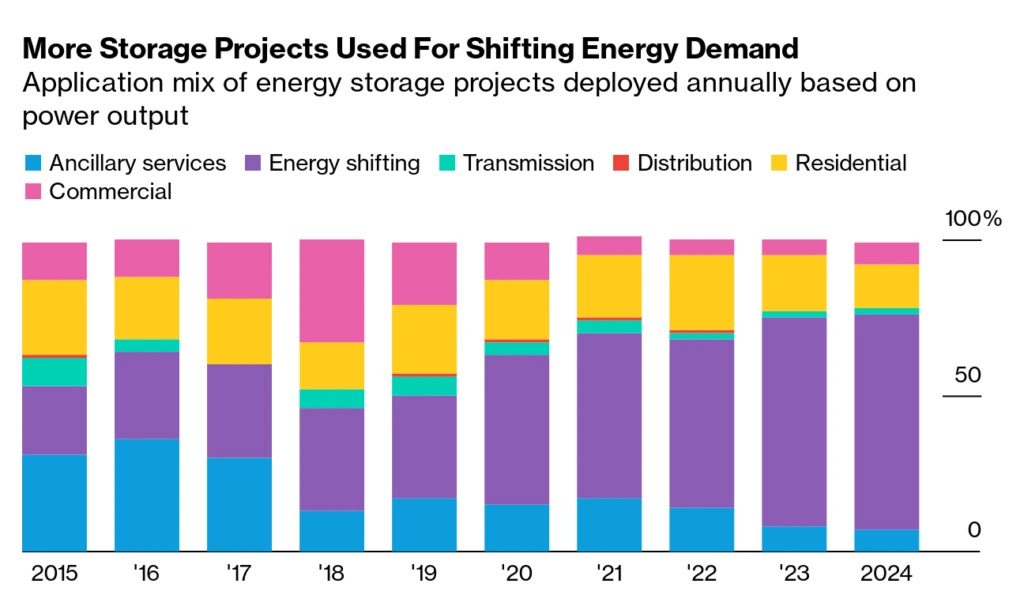

Over the past decade, energy shifting has become the dominant use case for stationary batteries, outpacing other applications (see Figure 2). In the early days, ancillary services like frequency regulation, spinning reserve, and voltage support were the main drivers of BESS deployment. While still important, these services are now overshadowed by bulk energy applications, which offer greater economic returns and a much larger addressable market.

The trend reflects a broader transformation: batteries are no longer merely a high-tech addition for grid smoothing. Instead, they’re becoming core infrastructure for the energy transition, enabling multi-hour storage and deep renewable penetration.

Why is LFP the Dominant Chemistry?

To understand LFP’s dominance, and what comes next, it helps to define the essential attributes for energy storage applications. At the most basic level, a viable energy-shifting battery must offer:

Low cost – to make large-scale deployment economically feasible.

Safety – to enable safe operation at scale, often near populated areas.

Long cycle life – to ensure profitability over years of daily charge–discharge operation.

High efficiency – to minimize losses through high round-trip efficiency (i.e., energy out divided by energy in).

Among these, cost is the decisive factor. As BESS increasingly behave like commodities, battery price becomes the primary driver of adoption. Batteries account for roughly half of total system cost, giving their price an outsized impact on project economics.

LFP cells have a clear edge here, generally costing 20–30% less than NMC batteries. Looking ahead, sodium-ion technology could reduce costs even further, potentially 20–30% below LFP once fully commercialized at scale. However, sodium-ion BESS remain more expensive today, constrained by immature supply chains and limited demand.2 For now, LFP is the cost leader, but sodium-ion is a strong contender for the next cost breakthrough if and when its economies of scale are realized.

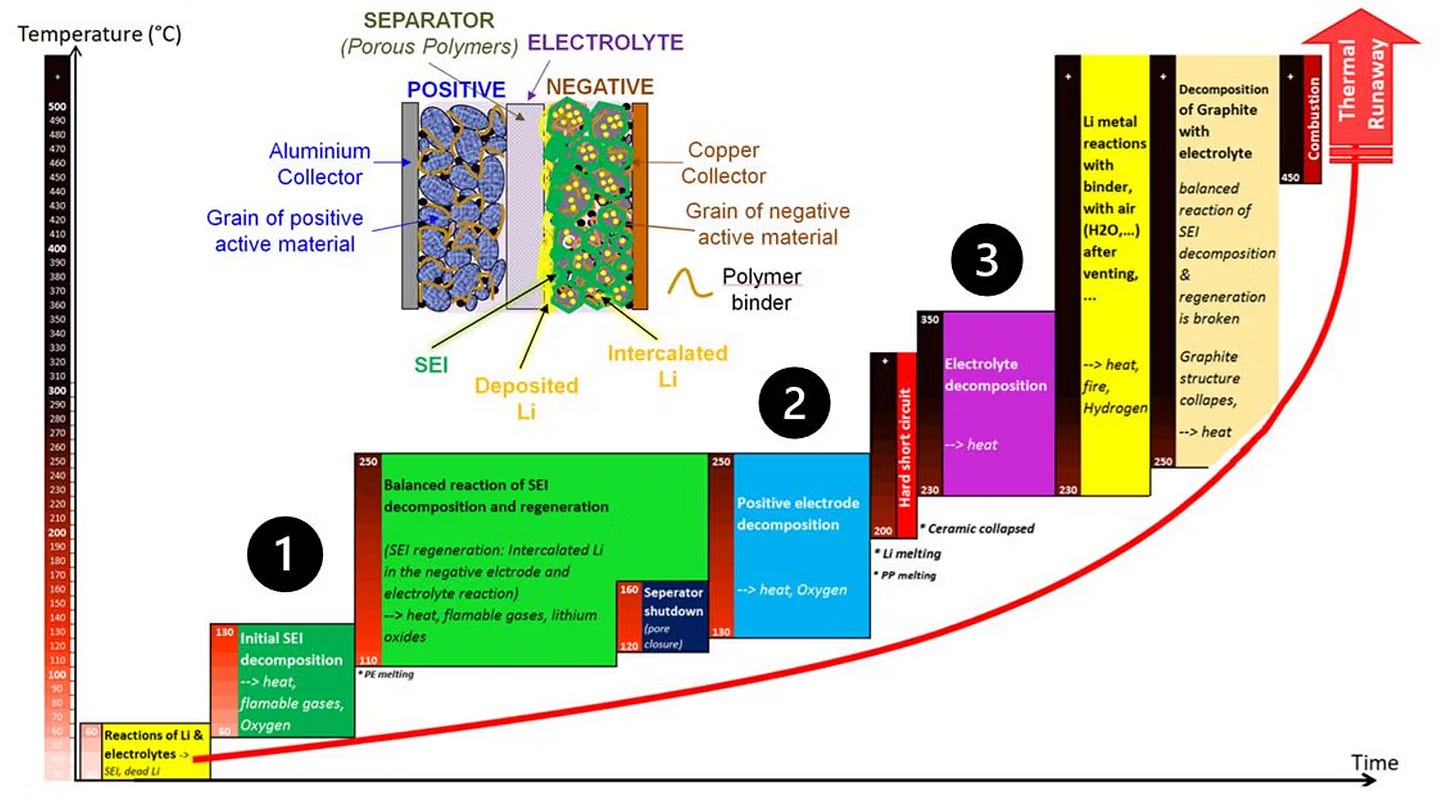

Next comes safety, a non-negotiable requirement, since systems are often installed near populated areas. One of the gravest hazards in battery systems is thermal runaway: a chain reaction where rising cell temperature triggers self-sustained heat generation, potentially leading to fires or explosions (Figure 3).

LFP excels in this regard. It has a higher onset temperature for thermal runaway, typically exceeding 230 °C, and releases less heat and oxygen during failure, reducing the risk of fire propagation. This robust safety profile is backed by extensive real-world data. In contrast, NMC batteries carry higher thermal risks, and many recent BESS incidents have involved NMC systems.

Sodium-ion batteries may be even safer, particularly when paired with non-flammable electrolytes, but sodium-ion safety is still an active area of research and development and its real-world record is still developing.

Closely tied to cost is cycle life: the number of full charge–discharge cycles a battery can deliver before its output falls below 70–80% of initial capacity.3 Longer cycle life reduces replacement frequency and total cost of ownership.

LFP typically exceeds 6,000 full cycles, while most NMC and sodium-ion chemistries today remain below 4,000 cycles (e.g., Faradion’s cell), though sodium-ion performance continues to improve as the technology matures.4

Finally, high roundtrip energy efficiency is a must, as it directly impacts operating costs and energy delivery reliability. LFP and NMC cells achieve around 90–95%, while sodium-ion ranges 85–90%, limited by larger ion size and electrolyte challenges.

When cost, cycle life, safety, and efficiency are considered together, LFP’s dominance is no surprise. It delivers the best overall balance of affordability, durability, safety, and efficiency for large-scale energy shifting applications.

The Next Contenders: Sodium-Ion, LMFP, and Zinc-Ion

Looking forward, sodium-ion stands out as the most credible contender. It offers a similar cycle life trajectory, potentially safer operation, and lower-cost materials. The key uncertainty is scaling: can it ramp up fast enough, drive down cost, and demonstrate field reliability?

Besides sodium-ion, lithium iron manganese phosphate (LMFP) and zinc-ion chemistries are also gaining attention for stationary energy storage:

LMFP closely resembles LFP but offers higher energy density, making it ideal for urban commercial and industrial (C&I) systems where space is limited. Its main hurdles remain stability and cycle performance.

Zinc-ion batteries, which use water-based electrolytes, are inherently non-flammable and ultra-safe, but currently face challenges with lower energy density and immature commercialization.

In the near future, we may see an LFP–LMFP duopoly, with LFP dominating large-scale systems and LMFP favored where energy density matters most. Zinc-ion batteries, meanwhile, remain further from commercial maturity and are likely to serve niche applications where ultra-low cost and safety outweigh energy density requirements.

Final Thoughts

With ongoing improvements in LFP batteries, from larger cell formats and cell-to-system designs that optimize footprint, to pre-lithiation strategies that extend cycle life and cost reductions driven by scale, LFP is poised to remain the dominant chemistry for stationary energy storage in the foreseeable future.

LMFP is emerging as a strong complementary technology, while sodium-ion remains the most credible challenger. Yet their ultimate impact will depend on how quickly these newer chemistries can mature, scale, and prove themselves in long-term field operation.

That’s all for now — until next time 🔋

If you enjoyed this post, please share it or subscribe — it helps more readers discover Lithium Horizons and supports future deep dives into the technologies shaping the energy transition.

Battery Storage for Resilience by NREL.

The average cost for sodium-ion cells in August 2025 is ~70 EUR/kWh.

Some BESS manufacturers have begun marketing their LFP systems as having a cycle life of 15,000 cycles. This figure is achieved by measuring capacity down to 50–60%, rather than the more common 70–80% — a marketing trick.

NMC cycle life largely depends on the type of NMC (e.g., NMC111, NMC532, etc.). Most of the time NMC cells will have a cycle life of around 2,000 cycles

Wait for sodium ion :)